Cryptocurrency is a digital or virtual currency that relies on cryptography to ensure security and perform financial operations (Hellwig et al., 2020) (Yi et al., 2022) (Almasri & Arslan, 2018). It operates through a decentralized consensus-database known as blockchain, which consists of entries of units called tokens or crypto tokens (Hellwig et al., 2020). Here’s a breakdown of what cryptocurrency is, how it works, its benefits, and associated risks:

What is Cryptocurrency?

Cryptocurrency is a digital or virtual currency designed to work as a medium of exchange, utilizing cryptography for security and financial operations (Hellwig et al., 2020) (Yi et al., 2022)(Almasri & Arslan, 2018).

It is decentralized and operates through a consensus-database called blockchain, which ensures the security and verification of transactions (Hellwig et al., 2020) (Aggarwal & Kumar, 2021).

How Does Cryptocurrency Work?

Cryptocurrency operates through a decentralized consensus-database known as blockchain, which is a public transaction database functioning as a distributed ledger (Hellwig et al., 2020) (Aggarwal & Kumar, 2021).

Transactions are verified and secured through cryptography, and the supply of new units is controlled using cryptographic techniques (Hellwig et al., 2020) (Almasri & Arslan, 2018) (Agarwal et al., 2024).

The first successful implementation of a peer-to-peer electronic cash system, completely independent from the traditional banking system, was Bitcoin, which was introduced in 2008 (Di Pietro et al., 2021).

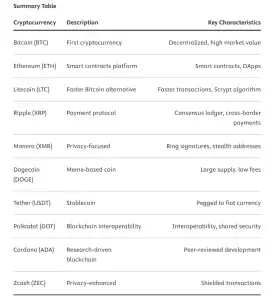

Types of Cryptocurrencies

- Bitcoin (BTC)

Description: The first and most well-known cryptocurrency, often considered the gold standard of cryptocurrencies.

Characteristics: Decentralized, uses blockchain technology, and is known for its high market value and significant impact on the global economy (Hairil et al., 2021) (Umamaheswari et al., 2023)(Aggarwal & Kumar, 2021).

- Ethereum (ETH)

Description: A decentralized platform that enables smart contracts and decentralized applications (DApps) to be built and run without any downtime, fraud, control, or interference.

Characteristics: Known for its smart contract functionality and being the second-largest cryptocurrency by market capitalization (Hairil et al., 2021) (Aggarwal & Kumar, 2021) (Bhattacharya et al., 2023) (Li & Whinston, 2020).

- Litecoin (LTC)

Description: Created as the “silver” to Bitcoin’s “gold,” Litecoin offers faster transaction confirmation times and a different cryptographic algorithm.

Characteristics: Faster block generation time and a different hashing algorithm (Scrypt) compared to Bitcoin’s SHA-256 (Hairil et al., 2021) (Aggarwal & Kumar, 2021) (De Rosa & Schiavoni, 2022).

- Ripple (XRP)

Description: A real-time gross settlement system, currency exchange, and remittance network.

Characteristics: Known for its consensus ledger and being used by financial institutions for cross-border payments (Hairil et al., 2021) (Aggarwal & Kumar, 2021) (Bhattacharya et al., 2023) (Li & Whinston, 2020).

- Monero (XMR)

Description: Focuses on privacy, decentralization, and scalability.

Characteristics: Uses ring signatures, stealth addresses, and confidential transactions to obfuscate transaction details (Hairil et al., 2021) (Aggarwal & Kumar, 2021) (Karnati et al., 2024).

- Dogecoin (DOGE)

Description: Initially created as a joke, it has gained a large following and is used for tipping and charitable donations.

Characteristics: Based on the popular “Doge” meme and has a large supply with low transaction fees (Karnati et al., 2024) (Daita et al., 2022).

- Tether (USDT)

Description: A stablecoin that aims to keep cryptocurrency valuations stable.

Characteristics: Pegged to the value of a fiat currency (e.g. USD), providing stability in the volatile cryptocurrency market (Aggarwal & Kumar, 2021).

- Polkadot (DOT)

Description: Aims to enable different blockchains to transfer messages and value in a trust-free fashion; sharing their unique features while pooling their security.

Characteristics: Focuses on interoperability between different blockchains (Bhattacharya et al., 2023).

- Cardano (ADA)

Description: A blockchain platform for changemakers, innovators, and visionaries, with the tools and technologies required to create possibility for the many, as well as the few, and bring about positive global change.

Characteristics: Known for its research-driven approach and peer-reviewed development (Bhattacharya et al., 2023).

- Zcash (ZEC)

Description: A cryptocurrency aimed at using cryptography to provide enhanced privacy for its users compared to other cryptocurrencies such as Bitcoin.

Characteristics: Offers the option of “shielded” transactions, which allow for content to be encrypted using advanced cryptographic techniques (毕红亮 et al., 2023).

These cryptocurrencies represent a diverse range of functionalities and use cases, from privacy and security to smart contracts and stable value. Each type has unique characteristics that cater to different needs and preferences in the digital currency market (Hairil et al., 2021) (Aggarwal & Kumar, 2021)(Bhattacharya et al., 2023) (Li & Whinston, 2020) (毕红亮 et al., 2023) (Karnati et al., 2024) (Karnati et al., 2024) (Daita et al., 2022).

Benefits of Cryptocurrency

Cryptocurrencies offer opportunities for financial inclusion, transparency, and innovation, revolutionizing the conventional financial environment (Agarwal et al., 2024).

They provide a medium of exchange that is secure, transparent, and operates without the need for intermediaries such as banks (Aggarwal & Kumar, 2021).

Cryptocurrencies have the potential to become a powerful tool for developing countries and combating financial problems, offering advantages such as decentralization, transparency, and low fees for transfers (Mirkamol & Mansur, 2024).

Risks Associated with Cryptocurrency

Regulatory uncertainties and market volatility are ongoing challenges that influence the path of cryptocurrencies as they establish themselves as a vital component of the global economy (Agarwal et al., 2024).

Cryptocurrencies are highly volatile, as evidenced by the fluctuating prices of Bitcoin, which reached a peak of above $69,000 and dropped to below $29,000 in 2021 (Khandelwal & Kaur, 2023).

Other risks associated with cryptocurrency include potential for collapse, network attacks, and high energy consumption due to mining (Khandelwal & Kaur, 2023).

In summary, cryptocurrency is a digital or virtual currency that operates through a decentralized consensus-database known as blockchain, utilizing cryptography for security and financial operations. While it offers benefits such as financial inclusion and transparency, it also presents risks such as regulatory uncertainties and market volatility. The first successful implementation of a cryptocurrency was Bitcoin, introduced in 2008, and it has since paved the way for numerous alternative cryptocurrencies such as Litecoin, Cardano, and Dogecoin (Yi et al., 2022).

How does blockchain technology secure cryptocurrency transactions?

Blockchain technology secures cryptocurrency transactions through several key mechanisms:

Decentralization

Distributed Ledger: Blockchain operates as a decentralized ledger, meaning that transaction records are maintained across multiple nodes in a network rather than a single central authority. This decentralization ensures that no single entity can control or manipulate the transaction data (Ahamad et al., 2022) (Taha & Alanezi, 2022) (Othman Albakri, 2021).

Peer-to-Peer Network: Transactions are verified by a network of participants (nodes) rather than a central authority, reducing the risk of centralized points of failure and enhancing security (Ahamad et al., 2022) (Taha & Alanezi, 2022) (Devisri et al., 2024).

Cryptographic Security

Encryption: Transactions are secured using cryptographic techniques, including public and private key pairs. This ensures that only the intended recipient can access the transaction details, maintaining confidentiality and integrity (Othman Albakri, 2021) (Devisri et al., 2024) (Senthilkumar, 2020).

Digital Signatures: Each transaction is signed with a digital signature, which verifies the identity of the sender and ensures that the transaction has not been altered. This adds an additional layer of security and authenticity (Senthilkumar, 2020) (Yu et al., 2022) (Thakre et al., 2024).

Hash Functions: Blockchain uses cryptographic hash functions (e.g. SHA-256) to create a unique identifier for each block of transactions. This makes it computationally infeasible to alter any transaction data without detection (Yu et al., 2022) (Thakre et al., 2024).

Immutability

Immutable Ledger: Once a transaction is recorded in a block and added to the blockchain, it cannot be altered or deleted. This immutability is achieved through cryptographic hashing and the linking of blocks in a chain, where each block contains a hash of the previous block (Devisri et al., 2024) (Songara et al., 2018) (Gergely & Crainicu, 2020).

Tamper-Proof: The decentralized and cryptographic nature of blockchain makes it highly resistant to tampering and fraud. Any attempt to alter a transaction would require altering all subsequent blocks, which is practically impossible due to the computational power required (Ahamad et al., 2022) (Songara et al., 2018) (Monrat et al., 2019).

Consensus Mechanisms

Validation: Transactions are validated through consensus mechanisms such as Proof of Work (PoW) or Proof of Stake (PoS. These mechanisms ensure that all nodes in the network agree on the validity of transactions before they are added to the blockchain (Banafa, 2022) (Wasim et al., 2023).

Byzantine Fault Tolerance: Some blockchain systems use algorithms like Practical Byzantine Fault Tolerance (PBFT) to achieve consensus even in the presence of malicious nodes, further enhancing security (Assiri & Khan, 2019).

Transparency and Auditability

Transparent Transactions: All transactions are recorded on a public ledger that is accessible to all participants. This transparency allows for easy auditing and verification of transactions, reducing the risk of fraud (Devisri et al., 2024) [10] .

Traceability: The blockchain provides a complete and traceable history of all transactions, which can be used to track the flow of funds and detect any suspicious activities (Ahamad et al., 2022) (Monrat et al., 2019).

Protection Against Attacks

51% Attack Resistance: Blockchain networks are designed to resist 51% attacks, where a malicious actor would need to control more than half of the network’s computational power to alter the blockchain. This is highly unlikely in large, well-established networks (Yu et al., 2022) (Thakre et al., 2024).

Double-Spend Prevention: The consensus mechanisms and cryptographic security measures in place prevent double-spending, ensuring that each cryptocurrency unit can only be spent once (Yu et al., 2022) (Thakre et al., 2024).

In summary, blockchain technology secures cryptocurrency transactions through a combination of decentralization, cryptographic security, immutability, consensus mechanisms, transparency, and robust protection against attacks. These features collectively ensure the integrity, authenticity, and security of transactions in the cryptocurrency ecosystem.

What are the key differences between Bitcoin and Ethereum?

Key Differences Between Bitcoin and Ethereum

Bitcoin and Ethereum are two of the most prominent cryptocurrencies, but they have several key differences that set them apart. Here are the main distinctions:

Purpose and Functionality

Bitcoin:

Primary Use: Bitcoin is primarily a digital currency designed for peer-to-peer transactions without intermediaries (Naaz & Saxena, 2022) (Yi et al., 2022) (Song et al., 2024).

Data Types and Transactions: It has a limited set of data types and transaction types, focusing mainly on the transfer of value (Naaz & Saxena, 2022).

UTXO Model: Bitcoin uses the Unspent Transaction Output (UTXO) model, which is simpler and less error-prone, as it only allows the creation or destruction of UTXOs [4] [5] .

Ethereum:

Primary Use: Ethereum extends beyond digital currency to support decentralized applications (dApps) and smart contracts, which are self-executing contracts with the terms directly written into code (Naaz & Saxena, 2022) (Yi et al., 2022) (Song et al., 2024).

Turing Completeness: Ethereum is Turing complete, meaning it can execute any computation that can be described algorithmically, allowing for more complex and versatile applications (Naaz & Saxena, 2022) (Song et al., 2024).

Account Model: Ethereum uses an account-based model, which allows for persistent storage and more expressive smart contracts, though it introduces complexity and potential side effects (Chakravarty et al., 2020) (Chepurnoy & Saxena, 2019).

Consensus Mechanisms

Bitcoin: Utilizes Proof of Work (PoW), which requires miners to solve cryptographic puzzles to validate transactions and secure the network (Nikolić et al., 2023) (Huang et al., 2021).

Ethereum: Initially used PoW but is transitioning to Proof of Stake (PoS) with Ethereum 2.0, which aims to improve scalability and reduce energy consumption (Nikolić et al., 2023) (Huang et al., 2021).

Transaction Speed and Scalability

Bitcoin: Processes around 7 transactions per second (TPS), which is relatively slow compared to traditional payment systems (Yadav & Shevkar, 2021).

Ethereum: Initially processed around 15 TPS, but ongoing upgrades aim to significantly increase this number (Yadav & Shevkar, 2021).

Smart Contracts and dApps

Bitcoin: Supports basic scripting for transactions but lacks the capability for complex smart contracts (Naaz & Saxena, 2022) (Song et al., 2024).

Ethereum: Designed specifically to support smart contracts and dApps, enabling a wide range of applications beyond simple transactions (Naaz & Saxena, 2022) (Song et al., 2024) (Fang et al., 2021).

Block Size and Performance

Bitcoin: Has a fixed block size limit, which can lead to congestion and higher transaction fees during peak times (Rouhani & Deters, 2017).

Ethereum: Does not have a fixed block size limit, but faces other challenges in processing unlimited transactions per second due to varying client performance (Rouhani & Deters, 2017).

Security and Vulnerabilities

Bitcoin: Generally considered secure due to its simpler UTXO model and extensive use (Chepurnoy & Saxena, 2019).

Ethereum: While powerful, its Turing-complete nature introduces potential security vulnerabilities, such as reentrancy attacks in smart contracts (Fang et al., 2021).

Market Position and Adoption

Bitcoin: The first cryptocurrency, often seen as digital gold, with a strong first-mover advantage and widespread recognition (Song et al., 2024) (Spurr & Ausloos, 2021).

Ethereum: Known for its greater functionality and potential to disrupt various industries through smart contracts and dApps, posing a significant threat to Bitcoin’s dominance (Song et al., 2024) (Spurr & Ausloos, 2021).

Reference

- Agarwal, M., Gill, K. S., Upadhyay, D., Dangi, S., & Chythanya, K. R. (2024). The Evolution of Cryptocurrencies: Analysis of Bitcoin, Ethereum, Bit connect and Dogecoin in Comparison. 2024 IEEE 9th International Conference for Convergence in Technology (I2CT), 1–6. https://doi.org/10.1109/I2CT61223.2024.10543872

- Aggarwal, S., & Kumar, N. (2021). Cryptocurrencies☆. In S. Aggarwal, N. Kumar, & P. Raj (Eds.), Advances in Computers (Vol. 121, pp. 227–266). Elsevier. https://doi.org/10.1016/bs.adcom.2020.08.012

- Almasri, E., & Arslan, E. (2018). Predicting Cryptocurrencies Prices with Neural Networks. 2018 6th International Conference on Control Engineering & Information Technology (CEIT), 1–5. https://doi.org/10.1109/CEIT.2018.8751939

- Bhattacharya, H., Agrawal, D., Walia, D., & Kumar, A. (2023). Cryptocurrency Trend Predictions through LSTM-Based Prediction. 2023 5th International Conference on Advances in Computing, Communication Control and Networking (ICAC3N), 1113–1116. https://doi.org/10.1109/ICAC3N60023.2023.10541754

- Daita, S. R., Choubey, S. B., & Choubey, A. (2022). A Journal on Cryptocurrency Analysis and Price Prediction Model using LSTM Neural Networks. 2022 International Conference on Recent Trends in Microelectronics, Automation, Computing and Communications Systems (ICMACC), 16–20. https://doi.org/10.1109/ICMACC54824.2022.10093540

- De Rosa, P., & Schiavoni, V. (2022). Understanding Cryptocoins Trends Correlations. In D. Eyers & S. Voulgaris (Eds.), Distributed Applications and Interoperable Systems (pp. 29–36). Springer International Publishing.

- Di Pietro, R., Raponi, S., Caprolu, M., & Cresci, S. (2021). Cryptocurrencies. In New Dimensions of Information Warfare (pp. 69–97). Springer International Publishing. https://doi.org/10.1007/978-3-030-60618-3_3

- Hairil, Cahyani, N. D. W., & Nuha, H. H. (2021). Ransomware Detection on Bitcoin Transactions Using Artificial Neural Network Methods. 2021 9th International Conference on Information and Communication Technology (ICoICT), 1–5. https://doi.org/10.1109/ICoICT52021.2021.9527414

- Hellwig, D., Karlic, G., & Huchzermeier, A. (2020). Cryptocurrencies. In Build Your Own Blockchain: A Practical Guide to Distributed Ledger Technology (pp. 29–51). Springer International Publishing. https://doi.org/10.1007/978-3-030-40142-9_2

- Karnati, V., Kanna, L. D., Pandey, T. N., & Nayak, C. K. (2024). Prediction and Analysis of Bitcoin Price using Machine learning and Deep learning models. EAI Endorsed Transactions on Internet of Things, 10. https://doi.org/10.4108/eetiot.5379

- Khandelwal, T., & Kaur, K. (2023). Blockchain, Cryptocurrency and It’s Future Analysis. 2023 International Conference on Advanced Computing & Communication Technologies (ICACCTech), 188–193. https://doi.org/10.1109/ICACCTech61146.2023.00038

- Li, X., & Whinston, A. B. (2020). Analyzing Cryptocurrencies. Information Systems Frontiers, 22(1), 17–22. https://doi.org/10.1007/s10796-019-09966-2

- Mirkamol, S., & Mansur, E. (2024). The Role of Cryptocurrencies in the Development of Countries and the Fight Against Financial Problems. In Y. Koucheryavy & A. Aziz (Eds.), Internet of Things, Smart Spaces, and Next Generation Networks and Systems (pp. 222–231). Springer Nature Switzerland.

- Umamaheswari, B., Mitra, P., Agrawal, S., & Kumawat, V. (2023). Impact of Cryptocurrency on Global Economy and Its Influence on Indian Economy. In V. S. Rathore, J. M. R. S. Tavares, V. Piuri, & B. Surendiran (Eds.), Emerging Trends in Expert Applications and Security (pp. 433–446). Springer Nature Singapore.

- Yi, X., Yang, X., Kelarev, A., Lam, K. Y., & Tari, Z. (2022). Cryptocurrencies. In Blockchain Foundations and Applications (pp. 83–96). Springer International Publishing. https://doi.org/10.1007/978-3-031-09670-9_4

- 毕红亮, 陈艳姣, 伊心静, & 汪旭. (2023). Game-based User Decision Optimization Analysis of Cryptocurrency Trading Market. Journal of Software, 34(12), 5477–5500.

- Ahamad, S., Gupta, P., Bikash Acharjee, P., Padma Kiran, K., Khan, Z., & Faez Hasan, M. (2022). The role of block chain technology and Internet of Things (IoT) to protect financial transactions in crypto currency market. Materials Today: Proceedings, 56, 2070–2074. https://doi.org/10.1016/j.matpr.2021.11.405

- Assiri, B., & Khan, W. Z. (2019). Enhanced and lock-free tendermint blockchain protocol. 2019 IEEE International Conference on Smart Internet of Things (SmartIoT), 220–226.

- Banafa, A. (2022). Blockchain technology and applications. River Publishers.

- Chakravarty, M. M., Chapman, J., MacKenzie, K., Melkonian, O., Peyton Jones, M., & Wadler, P. (2020). The extended UTXO model. Financial Cryptography and Data Security: FC 2020 International Workshops, AsiaUSEC, CoDeFi, VOTING, and WTSC, Kota Kinabalu, Malaysia, February 14, 2020, Revised Selected Papers 24, 525–539.

- Chepurnoy, A., & Saxena, A. (2019). Multi-stage contracts in the UTXO model. Data Privacy Management, Cryptocurrencies and Blockchain Technology: ESORICS 2019 International Workshops, DPM 2019 and CBT 2019, Luxembourg, September 26–27, 2019, Proceedings 14, 244–254.

- Devisri, M., Vetriselvan, V., Baskar, M., Mylapalli, M., Jayabalan, K., & Mouli, S. K. M. K. (2024). Blockchain Innovations for Secure Online Transactions. In Strategies for E-Commerce Data Security: Cloud, Blockchain, AI, and Machine Learning (pp. 523–545). IGI Global.

- Fang, Y., Wang, C., Sun, Z., & Cheng, H. (2021). Jyane: Detecting Reentrancy vulnerabilities based on path profiling method. 2021 IEEE 27th International Conference on Parallel and Distributed Systems (ICPADS), 274–282.

- Gergely, A. M., & Crainicu, B. (2020). Randadminsuite: A new privacy-enhancing solution for private blockchains. Procedia Manufacturing, 46, 562–569.

- Huang, K., Ma, J., & Wang, X. (2021). A comparative analysis of bitcoin and ethereum blockchain. 2021 2nd International Seminar on Artificial Intelligence, Networking and Information Technology (AINIT), 678–682.

- Monrat, A. A., Schelén, O., & Andersson, K. (2019). A Survey of Blockchain From the Perspectives of Applications, Challenges, and Opportunities. IEEE Access, 7, 117134–117151. https://doi.org/10.1109/ACCESS.2019.2936094

- Naaz, R., & Saxena, A. K. (2022). A study of bitcoin and Ethereum blockchains in the context of client types, transactions, and underlying network architecture. In System Assurances (pp. 229–269). Elsevier.

- Nikolić, S., Zdravković, N., Franc, I., & Arivazhagan, N. (2023). A Comparison on Hyperledger Consensus Mechanism Security and their Applications.

- Othman Albakri, A. (2021). Blockchain and the Internet of Things: Opportunities and Challenges. 2021 International Conference on Software Engineering & Computer Systems and 4th International Conference on Computational Science and Information Management (ICSECS-ICOCSIM), 183–188. https://doi.org/10.1109/ICSECS52883.2021.00040

- Rouhani, S., & Deters, R. (2017). Performance analysis of ethereum transactions in private blockchain. 2017 8th IEEE International Conference on Software Engineering and Service Science (ICSESS), 70–74.

- Senthilkumar, D. (2020). Blockchain and Its Integration as a Disruptive Technology. In AI and Big Data’s Potential for Disruptive Innovation (pp. 261–290). IGI Global.

- Song, H., Wei, Y., Qu, Z., & Wang, W. (2024). Unveiling Decentralization: A Comprehensive Review of Technologies, Comparison, Challenges in Bitcoin, Ethereum, and Solana Blockchain. arXiv Preprint arXiv:2404.04841.

- Songara, A., Chouhan, L., & Kumar, P. (2018). Blockchain Security for Wireless Multimedia Networks. In Cryptographic and Information Security Approaches for Images and Videos (pp. 745–772). CRC Press.

- Spurr, A., & Ausloos, M. (2021). Challenging practical features of Bitcoin by the main altcoins. Quality & Quantity, 55(5), 1541–1559.

- Taha, M. M., & Alanezi, M. (2022). Cryptocurrencies in Blockchains Environment: The Verification Trip. 2022 4th International Conference on Current Research in Engineering and Science Applications (ICCRESA), 159–164. https://doi.org/10.1109/ICCRESA57091.2022.10352512

- Thakre, G., Saratkar, S., Raut, R., Chaudhari, A., Thute, T., & Verma, P. (2024). Blockchain-based Cryptocurrency Security Analysis Technology-A Review. 2024 International Conference on Inventive Computation Technologies (ICICT), 1536–1542.

- Wasim, M., Chauhan, C. K., Singh, A. P., & Gupta, A. (2023). Crypto-Transfer Bitcoin and Ethereum: A Brief Overview. 2023 International Conference on Advancement in Computation & Computer Technologies (InCACCT), 790–794.

- Yadav, J., & Shevkar, R. (2021). Performance-based analysis of blockchain scalability metric. Tehnički Glasnik, 15(1), 133–142.

- Yi, X., Yang, X., Kelarev, A., Lam, K. Y., & Tari, Z. (2022). Bitcoin, Ethereum, Smart Contracts and Blockchain Types. In Blockchain Foundations and Applications (pp. 25–65). Springer.

- Yu, C., Yang, W., Xie, F., & He, J. (2022). Technology and security analysis of cryptocurrency based on blockchain. Complexity, 2022(1), 5835457